Bitcoin is the world’s freedom money, but over the years as it continues to grow, regulatory capture and other political tactics are being played in an effort to suppress Bitcoin from realizing its true potential.

No-KYC Bitcoin represents freedom money in its purest form, enabling its holders unlimited financial freedom to transact privately on their own terms, without risk of simple theft or seizure.

While having “freedom money” may sound cool and all, what are the benefits of no-KYC Bitcoin that you can actually expect to enjoy yourself?

What is KYC?

First of all, it’s helpful to understand what KYC is in the first place to truly appreciate no-KYC Bitcoin.

KYC, or “Know Your Customer,” is a standardized process of collecting and verifying the identities of customers who interact with businesses. It aims to let them know that they are actually working with real customers instead of bots or criminals.

KYC collects information about your name, home address, phone numbers, some form of government ID, and potentially more, depending on the exchange.

In the context of Bitcoin, centralized exchanges – where you purchase Bitcoin – enforce KYC procedures to comply with the regulatory regime. Mainstream ETF providers like Fidelity and BlackRock – who are likely to onboard billions, if not trillions, of dollars in capital to Bitcoin – all KYC gate their platforms so you give up your personal information before buying into a fiat-denominated IOU that they hold for you.

That isn’t the vision Satoshi saw for Bitcoin.

The Problem With KYC

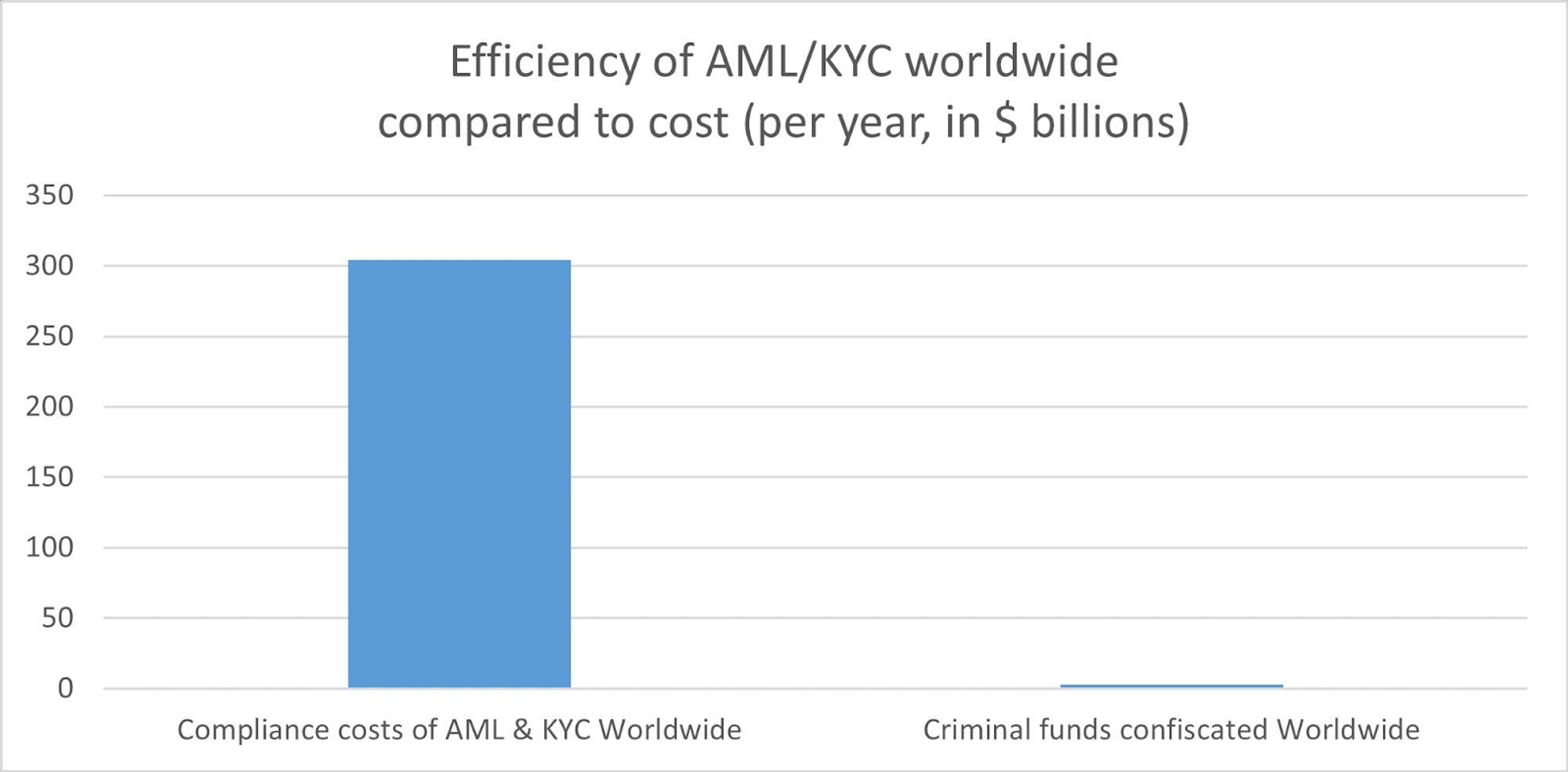

While it’s all done in the name of protection, KYC actually ends up wasting more resources than those actually lost due to illicit financial activity, and endangering people’s online activity by collecting their data into a honeypot.

Based on estimates of Europol data from author Olivier Roland, who details the greater dangers of KYC, we learn that the EU spends ~€144 billion on KYC/AML (anti-money laundering) compliance costs each year, while only confiscating ~€1.2 billion in criminal funds.

So while KYC/AML protection may have good intentions, the costs far outweigh the benefits.

All that KYC really does is dox the identities of everyday people and put them at risk. Just look at MobiKwik, a major payment provider in India. In March 2021, during the height of the previous bull run, a hacker managed to crack MobiKwik’s centralized network and execute one of the largest KYC data leaks in history. The hacker allegedly gained access to the entire customer KYC database, which he then offered up to the darkweb in exchange for 1.5 BTC.

Some of the data the hackers could get their hands on included:

- 7.5 TB of over 3 million merchants KYC data, including credit card information, passport details, and KYC selfie images of individuals

- 40 million 10-digit card numbers with month, year, and card hash

- 99 million mail, phone passwords, and addresses

- 350GB of MySQL dumps

- Data on installed apps, IP addresses, GPS locations, and more

- Other company databases

If you ever receive lots of spam calls to your phone number, email, or other online accounts, it’s likely due to the years of major data leaks like these that end up harming citizens forced to KYC themselves.

You may want financial sovereignty, and while Bitcoin can enable that for anyone through self custody, purchasing your coins through a KYC-gated exchange allows them to track that Bitcoin’s activity on the ledger, even after you move the Bitcoin off of the exchange (unless you mix your Bitcoin after the fact, but we’ll touch more on that later).

If you want to truly make your finances private and enjoy the full freedom of holding your own money, then no-KYC Bitcoin is what you’re looking for.

What is no-KYC Bitcoin?

As the name suggests, no-KYC Bitcoin is Bitcoin avoids all of that data collection that KYC processors enforce. No-KYC Bitcoin therefore keeps its holder’s identity entirely private since it has no transaction history associated with any KYC databases.

It’s the Bitcoin that you earn anonymously from mining, routing Lightning payments, payments from anonymous customers online or in person, or through purchases via no-KYC Bitcoin exchanges.

No-KYC Bitcoin gives you the freedom to save and spend privately without anyone being able to keep track of your activity.

While many people make sure to note that buying no-KYC sats typically comes with an additional percentage point premium above its current price, it’s worth considering that the “standard” price you pay at KYC exchanges is actually discounted, because you’re also paying with your data.

But once once you get your hands on no-KYC Bitcoin for the first time, there are plenty of benefits you’ll enjoy that handing out your data alongside your cash to KYC exchanges can’t offer.

10 benefits of no-KYC Bitcoin

Not every single benefit listed here may apply to you, but understand that no-KYC Bitcoin can benefit anyone, regardless of their circumstances.

1. Maximizing privacy: No-KYC Bitcoin cannot be easily tied to your identity by any outside parties, so you and you alone have untethered access to manage your money without financial surveillance.

2. Censorship resistance: Since you can’t track no-KYC Bitcoin, it’s the only money in the world that you can spend anywhere, as no local regime even has the potential to block transactions from Bitcoin that they don’t even know exists. This mitigates the off-chance situation where a particularly hostile government sees your Bitcoin spending within the country and comes knocking at your door to stop it.

3. Confiscation resistance: You also won’t have to worry about having your Bitcoin seized if it’s truly no-KYC. In the event of an Executive Order 6102-style confiscation, only those who’ve given up their keys and personal information to KYC’d custodians would possibly lose their Bitcoin. Meanwhile, you could sleep easy at night.

4. Accessible anytime, anywhere: No level of government censorship or limited “trading hours” will prevent you from accessing your money when you need it. With no-KYC Bitcoin, you won’t have to rely on the timing or rules of any other organization to access and spend your Bitcoin. There is a long history of exchanges suddenly blindsiding users, preventing them from withdrawing or moving their Bitcoin at all, and even cutting them off entirely from access to their account. All the while, deliberately doxxing their customer data for the world to see (I’m talking about Celsius).

5. Strengthening the Bitcoin network: The more KYC’d the Bitcoin network becomes, the more controls that the government can try to exercise over the network. While centralized entities are never fully able to contain decentralized networks over time, KYC certainly makes it easier, and delays Bitcoin adoption in the long run. On the other hand, no-KYC Bitcoin upholds the resilience of the Bitcoin network, as it creates more coins that are impossible for an external party to coerce or manipulate.

6. Protection against data breaches: Because your Bitcoin isn’t tied to any KYC databases, you don’t run the risk of having information about you owning that Bitcoin leaked online to hackers or scammers. Your money should never be a source of risk for your privacy, and no-KYC Bitcoin is the only money that’s capable of doing that.

7. Anonymous loans: With more practical application, you can fund loans entirely anonymously, enabling you the flexibility of financial instruments while maintaining your privacy. Platforms like lend.hodlhodl.com let you take out Bitcoin loans for other crypto, including stablecoins if you’re looking for a cash equivalent loan.

8. Anonymous donations: In case your region of the world doesn’t support charitable actions towards particular groups, you can use no-KYC Bitcoin to fund donations wherever you’d like and truly speak with your money. Or, you can use it to support freedom tech that’s enabling individual sovereignty for people around the world.

9. Use only in case of emergency: To adapt to the current monetary regime of today while still taking advantage of Bitcoin, you can choose to fund your everyday expenses and bills with your KYC Bitcoin stack, and save a smaller portion of your stack as no-KYC Bitcoin. This way, you can take the right step forward towards adopting a Bitcoin standard, while also hedging against government overreach. This is a practical first step for any new bitcoiner to take with no-KYC Bitcoin. And as always, hold your own keys, KYC’d Bitcoin or not, to prevent anyone from taking your wealth away from you.

10. Exploring the Bitcoin and privacy ecosystem: Developers all over the world are building encrypted messengers, social networks, open-source VPNs, and other privacy-focused tools to protect people’s online lives. Some of these platforms accept Bitcoin payments, making them a perfect outlet for spending your no-KYC Bitcoin. KYCnot.me is an excellent resource for exploring some Bitcoin platforms and other no-KYC privacy tools that you can spend your no-KYC sats on, on-chain or over Lightning, as well as Monero, fiat, and even cash.

The unfortunate irony

Although no-KYC Bitcoin comes with its many benefits as freedom money, the rails to acquiring and spending it aren’t so free and easily accessible.

Governments have always tried to suppress the people’s ability to access freedom tech like no-KYC Bitcoin; just look at the Catholic Church’s reaction to the printing press, or North Korea’s handling of the internet today.

Incorporating no-KYC Bitcoin into your daily life isn’t as practical in 2024. The good news, however, is that the benefits shared here go to show how much easier this technology is for people to access and take advantage of.

Regardless of the invasive policies that governments try (and fail) to enforce on protocols and their users, the technological trend historically wins out over time. Governments learn to play to the rules of technology instead of dictating them themselves. Historically the US dollar has managed to call the shots, but Bitcoin is here to update the rule book while enabling truly anonymous, private financial lives for anyone with an internet connection.

How to acquire no-KYC sats

So, to get your hands on no-KYC sats, you have a few different options.

- Buy from decentralized peer-to-peer exchanges: Probably the most simplest way, plenty of no-KYC Bitcoin exchanges are out there, including Bisq, HodlHodl, and many others. These platforms offer all different kinds of payment methods so you always have a way to buy Bitcoin without KYC. Be aware, however, that not all decentralized exchanges are created equal, and come with their own set of risks.

- Earn through integrating Bitcoin into your own business/service: If you operate a revenue-generating business, consider accepting Bitcoin as payment! Not only will you earn in the hardest money on earth, but having a direct source of no-KYC Bitcoin is a surefire way to uphold your financial sovereignty.

- Run a Lightning node: Routing transactions through your own Lightning node is another great passive source of no-KYC Bitcoin. Once you set things up, all you need to do is keep the node running, and you’ll have a steady stream of anonymous Bitcoin ready for you to use. It might not be much, but it’s honest Bitcoin.

- Mine Bitcoin yourself: Last but not least, mining Bitcoin is the most straightforward way of acquiring no-KYC sats. After setting up your first rig, mining no-KYC Bitcoin only becomes easier. There are a lot of steps involved with Bitcoin mining, and it often won’t be profitable initially. So be sure to do thorough research before getting started with Bitcoin mining, and consider the other options first if you want to save on costs.

How to clean your KYC stack

“If I have sats that are already KYC’d, is there a way I can de-KYC them?”

Not really, unfortunately. Once you purchase Bitcoin from a KYC exchange, they immediately log:

- Your personal credentials and banking information

- Exactly how much BTC you bought

- Exactly when you bought it

- The BTC address you withdraw to

- Your transaction patterns

- Communication records

- Your IP address and device information

After withdrawing to self custody, if you don’t do anything more to protect your Bitcoin’s privacy, then that exchange would be able to track all further transactions you make.

If you want to clean Bitcoin without anyone knowing that you purchased it or being able to see where you’re spending it, then you’ll have to sell that BTC back to fiat, bite the bullet and pay the incurred capital gains tax, and put your fiat towards one of the no-KYC Bitcoin sources mentioned above.

Alternatively, if you want more privacy but don’t care if others know that you once bought the Bitcoin, you just don’t want anyone seeing your activity, then you need to consider forward-looking privacy tools. Samourai’s CoinJoin was one of the most popular ones out there, but after the recent crackdown on Samourai, you’ll have to try other alternatives like JoinMarket.

Doing so will scramble your Bitcoin’s history, making it much more difficult to track the true owner. It’s not totally foolproof, assuming your transactions are being targeted, and especially if they’re tied to criminal activity. But for the everyday person, organizations with limited information like a Bitcoin exchange simply wouldn’t have the incentive or take the time to trace your activity. However, they would know that you mixed your coins, which may be a reason to target the address or add it to a smaller dataset of BTC addresses using mixers.

Keep in mind that these “solutions” are a temporary fix to a greater problem. Users shouldn’t have to act themselves to improve their privacy. We need privacy-first solutions that keep users protected from the very beginning when getting involved with Bitcoin. It needs to feel as intuitive as our favorite mainstream platforms are today. With time, it may come as the network continues to iterate, but it takes the efforts from every one of us to either integrate new privacy technology into our lives or create it ourselves!

Be sure to understand these implications, but don’t let them stop you from enhancing your Bitcoin’s privacy.

The bigger picture

All of the problems we see arise from KYC today stem from an attempt to solve a problem using broken infrastructure.

Today’s internet is critically lacking a security layer that can protect our data effectively without relying on counterparty risk. It’s the same problem plaguing our money too. Bitcoin is here to solve both of these realms for us.

The Bitcoin price alone demonstrates how effective it is at maintaining wealth over time, but with new application layers emerging on Bitcoin so rapidly today, we’re witnessing the emergence of a truly secure internet that the world has been working towards.

Communication platforms like Nostr are empowering its users to secure their voice with Bitcoin rather than relying on counterparties like Elon Musk or some other company spokesperson. There’s a buy-in incentive for others to adopt these protocols, that individually could only be financial, but collectively is beneficial for freedom at large.

Ultimately, Bitcoin is restoring free market mechanics to a world that’s been driving on monetary debasement, bailouts, and fraud. Technologies like Bitcoin are the natural responses to these problems, much like how the human body responds to a virus.

Government-ran legislature just doesn’t keep pace with the tactics and tools being used to avoid them. Invasive policies like KYC and surveillance tools like CBDCs, on top of an insecure internet, create an environment akin to walking through a landmine field for everyday people. And with the rate of technological expansion, the sophistication in cybercrime will only become greater and easier to fall into.

Conclusion

Buying, holding, and spending no-KYC Bitcoin is the only way that we’ve ever been able to enjoy financial sovereignty and grow our wealth over time without any risk of censorship, debasement, or theft.

Bitcoin that you bought through KYC exchanges and withdrawn to your own custody certainly still works just as Bitcoin is designed to, but if you don’t want third parties tracking the activity of your Bitcoin holdings, then you’ll need to get your hands on no-KYC sats for ultimate privacy.

It all comes down to your own needs. While privacy may not seem so important to some, rapid developments in technology make the internet’s need for privacy greater than ever before.

Join the Conversation

If this post has sparked an idea or motivated you to get involved, there is no better next step than to join the conversation here at freedom.tech! Subscribers can jump straight into the comments below, or you can join our community SimpleX group:

If you have feedback for this post, have something you'd like to write about on freedom.tech, or simply want to get in touch, you can find all of our contact info here: