When it comes to the topic of freedom or oppression, no single technology carries as much weight as money itself. This fact has led to the developments of freedom-focused digital currencies since the late 1980s, starting with the development of “DigiCash” in 1989 by legendary cypherpunk forefather David Chaum. Chaum saw far into the future, long before governments or central banks noticed the power they could grasp through the use of digital currencies. In 1992 he wrote for the Scientific American on the crossroads we are at today with digital payments:

In one direction lies unprecedented scrutiny and control of people's lives; in the other, secure parity between individuals and organizations. The shape of society in the next century may depend on which approach predominates.

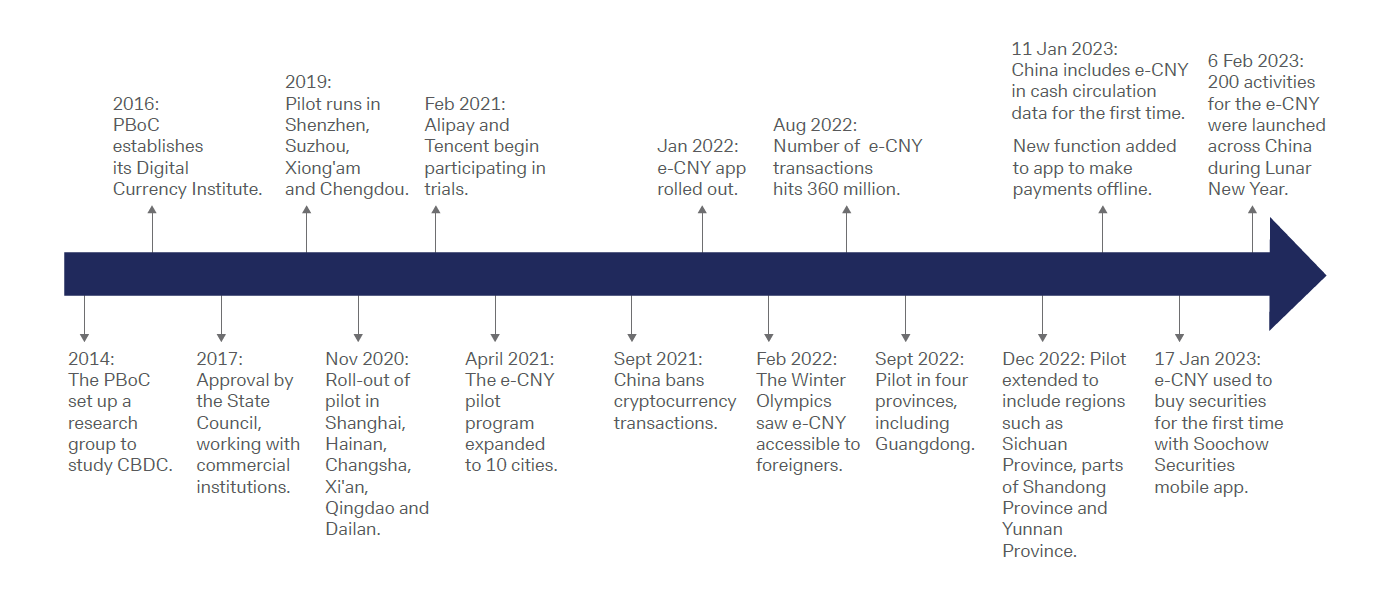

The dangerous future where governments and central banks have “unprecedented scrutiny and control of people's lives” has come to fruition in the rapidly advancing central bank digital currency (CBDC) programs across the globe, and China is leading the way towards this dystopian possibility. Launching their CBDC, the “e-CNY,” in November of 2020 kick-started the arms race between countries to introduce surveilled and controllable digital currencies of their own. The e-CNY has quickly gained larger adoption as the government of China rolls it out to more citizens and businesses alongside enticing incentives like Yuan giveaways, practically free train tickets, and even forcing government employees to accept their wages entirely in the e-CNY.

What even is a “CBDC?”

Central Bank Digital Currencies — or “CBDCs” — are a massive new experiment being conducted by most governments around the world. The aim of CBDCs is to shift fiat money (US Dollars, British Pounds, etc.) into the digital age and away from cash, ostensibly bringing with it benefits like decreased costs and easier user experience. Nestled beneath those claims, however, is the sinister side of CBDCs, one where governments realize almost total control of the financial system in an unprecidented way.

If a government that's currently operating a totalitarian surveillance state, committing genocide, and crushing free cities is very interested in a financial technology, you have to ask yourself: why?

The country leading the way in this experiment is China, setting the standard for CBDCs with it’s e-CNY. “[Chinese Communist Party] authorities have been on record for years stating why they wanted CBDCs: to give more power and control to the government, and take power away from corporations and people,” says Alex Gladstein, CSO of the Human Rights Foundation. Gladstein has been tirelessly fighting for human freedom via the HRF and organizing the Oslo Freedom Forum since 2009.

While we may all be used to digital payments via tools like PayPal and Cash App today, these tools still rely on a middleman holding fiat as a liability themselves. This gives a layer of separation and protection from central banks to their users, despite the added costs and issues that come with these centralized payment platforms. CBDCs aim to replace physical cash with a digital version that ties citizens accounts directly to their country’s central bank. “It is this [direct tie] that opens the door to so many human rights concerns when it comes to the adoption of CBDCs” according to the CBDC Tracker, a website dedicated to allowing people to keep a watchful eye on CBDC development and usage across the globe.

"If a government that's currently operating a totalitarian surveillance state, committing genocide, and crushing free cities is very interested in a financial technology, you have to ask yourself: why?”

Who watches the watchers?

Gladstein and the HRF quickly realized that more had to be done after China began experimenting in earnest with CBDCs. Gladstein said that “[t]he Chinese Communist Party's early experiments with central bank digital currencies are really what first got my attention.” For most of us around the world, at best we’ve heard the term “CBDC,” though even then most don’t understand what they are or how governments are seeking to leverage them. In 2023 the HRF created a fellowship around tracking the progress of CBDC development and implementation around the world.

This fellowship resulted in the CBDC Tracker, a website that educates visitors and makes it easy to follow along with the progress governments are making in their quest for centralized control of money. “Authoritarian governments are leading the charge on CBDC experimentation and implementation, and there was no project tracking this: HRF was happy to support such a thing for the benefit of the global public,” said Gladstein. While they’ll be launching their full tracker in November of this year, the site is live now and has valuable resources for those seeking to learn more.

In order for the common citizen to be able to properly fight back against the growth of CBDCs, they have to be armed with information about how their local governments are approaching them and the CBDC Tracker aims to do just that. Pulling back the veil on government experiments and motives around CBDCs is vital to this aim.

CBDCs and human rights

So what’s the big deal? We’ve had central banks for decades and cash has been going the way of the cavemen for years. But what many don’t realize is that cash and the layer of separation we’re used to from central banks have both been key deterrents to the growth of totalitarian regimes around the world. Cash has immense utility even today as it provides a way to pay others without revealing information to the outside world (or even the central bank) about the payments, as well as protecting citizens from easy totalitarian control. It’s incredibly difficult for a government to surveil and control the use of physical cash due to its inherent properties, but that difficulty goes away with CBDCs.

As always with CBDCs, we have only to look at China to get a picture of what we can expect. “The Chinese CBDC features expiration dates on money and blacklists,” says Gladstein. “Both of these things are, in my view, human rights violations.” CBDCs allow central banks (and thus governments) unprecedented surveillance and control over the accounts and activities of the average citizen. While initially this could look just like tighter accounting for tax purposes, CBDCs would grant governments the ability to freeze or confiscate funds at will, build troves of data on their citizens payment activity, and block activists, dissidents, or journalists from accessing the economy.

Picture this: you’re frustrated with the state of government control in your country and have started to wield your skills as a writer to expose government overreach and human rights violations on a blog you started. One day you wake up to go to work at your day job as a journalist, go to grab a cup of coffee on your way, and realize that your payments are all being denied. Your government CBDC app gives you a simple ultimatum — take down your blog and your accounts will be unfrozen. While this scenario may seem far fetched, far worse has happened to those who chose to speak against totalitarian governments.

When a government has direct access and control to your finances, their ability to use “carrot and stick” incentives and disincentives to drive social behavior that grants them more power becomes trivial. With the flick of a switch they can pause your accounts or even take funds directly out of your wallet. Even if this starts out as “merely” a tool to be used against criminals, it can easily be turned against average citizens whose views don’t align with those of their government.

Without access to the broader economy, all other human freedoms rapidly deteriorate around us. Those who would seek to hold governments accountable or slow the slide towards totalitarianism that is becoming prolific around the globe would face trivial blacklists and censorship, making the ability to merely buy food each day incredibly difficult. True democracy and human freedom hinge on the ability to express ourselves freely, and how and where we spend our money is one of the purest forms of expression available to us.

Choosing the other path

If CBDCs are the path towards “unprecedented scrutiny and control of people's lives” that Chaum talked about all the way back in 1992, how do we fight for the alternative, a “secure parity between individuals and organizations?” For many it may seem daunting to push back on a coordinated effort by central governments to develop and implement CBDCs, but there are realistic steps we can take today. Chief among those steps is to start using tools that allow us to opt out of a CBDC economy, tools like Bitcoin. Gladstein sees Bitcoin as an “escape from the walled, gated, CBDC system.”

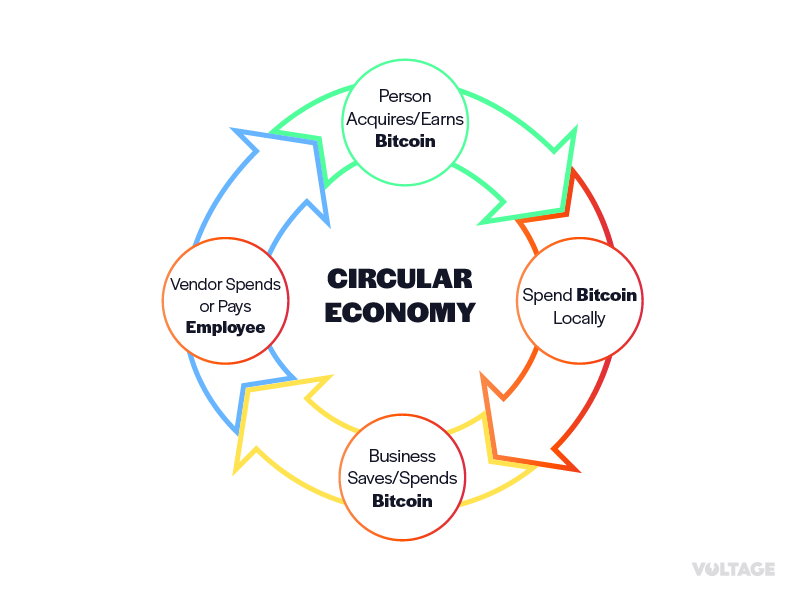

According to Gladstein, Bitcoin is alternative in which we can save our hard-earned money, buy and sell goods and services directly with others in our community, and buy the things that will quickly become impossible to buy under a CBDC economy. Bitcoin detaches money from the state and finally gives power back to the individual, in a way that is even more powerful than mere cash (as good a tool as it is) can do today. When you own and take custody of Bitcoin yourself, no totalitarian regime or dictator can easily confiscate funds or blacklist you from sending or receiving. Bitcoin is, quite literally, the anti-CBDC.

Bitcoin is an escape from the walled, gated, CBDC system.

While Bitcoin is still growing as a tool we can use for day-to-day payments, it presents the most powerful way that we can opt out of a broken economy that is controlled by central banks. In order to do that, though, we first have to choose to opt into Bitcoin’s economy, use it, and advocate for others to join the new economy as well.

Gladstein also outlined three major ways that the average citizen can take steps to push back on the growth of CBDCs:

- Advocate for the preservation of cash.

- Cash remains a powerful tool for privacy and financial freedom as long as governments allow it, and should be utilized and fought for as much as possible.

- Advocate for the ban of CBDCs.

- In those states where we still wield some democratic control, we can step up and push our representatives and government officials to get laws on the books banning the implementation and use of CBDCs.

- This is already happening in some states in the US, starting with Florida.

- Help support Bitcoin peer-to-peer economies and businesses.

- Bitcoin is only as useful as it’s circular economy, and we each can play our part in helping that economy to grow. Spending Bitcoin where possible, advocating for merchants to accept it and helping them to do so, and accepting Bitcoin at any business you run helps to accelerate the growth of Bitcoin as a tool for freedom.

- This can be as simple as starting to pay your friends back for meals out or movie tickets in Bitcoin, getting them used to sending and receiving Bitcoin and giving them “skin in the game.”

Education is key

For many of us in the Western world, the concept of a CBDC is totally foreign. While rumblings of CBDCs are starting to happen in the US as some states like Florida seek to ban their use, Gladstein agrees, saying that his “sense is that the average American does not know what a CBDC is.” Those who stand to benefit most from the fog of war surrounding CBDCs are governments themselves, as a public in the dark is one that cannot push back against their aims. That is why one of the most powerful steps we can take in the fight against CBDCs and financial control is one of education.

This importance is why we chose to dedicate one of our first articles at Freedom.Tech to bringing awareness to CBDCs and those fighting against them, and why they will continue to be a topic of focus for us as they are built out by governments across the globe. Each of us have a responsibility (and the tools, thankfully!) to push back on the growth of CBDCs and the threat to human rights they pose. We are optimistic that we can stem the tide of totalitarian control over finances when we leverage the incredible community of activists, dissidents, and developers educating and building tools for freedom worldwide.

Join the Conversation

If this post has sparked an idea or motivated you to get involved, there is no better next step then to join the conversation here at freedom.tech! Subscribers can jump straight into the comments below, or you can join our community SimpleX or Signal groups:

If you have feedback for this post, have something you'd like to write about on freedom.tech, or simply want to get in touch, you can find all of our contact info here: