While many already in the freedom tech community may be familiar with the dangers and rapid development of central bank digital currencies (CBDCs) across the globe, a serious education issue still exists. The Human Rights Foundation (HRF) launched a fellowship in February 2023 with the goal of tracking the progress of CBDCs around the world and educating the average person on the risks of CBDCs broadly. Today, the HRF revealed the excellent output of that fellowship in the CBDC Tracker.

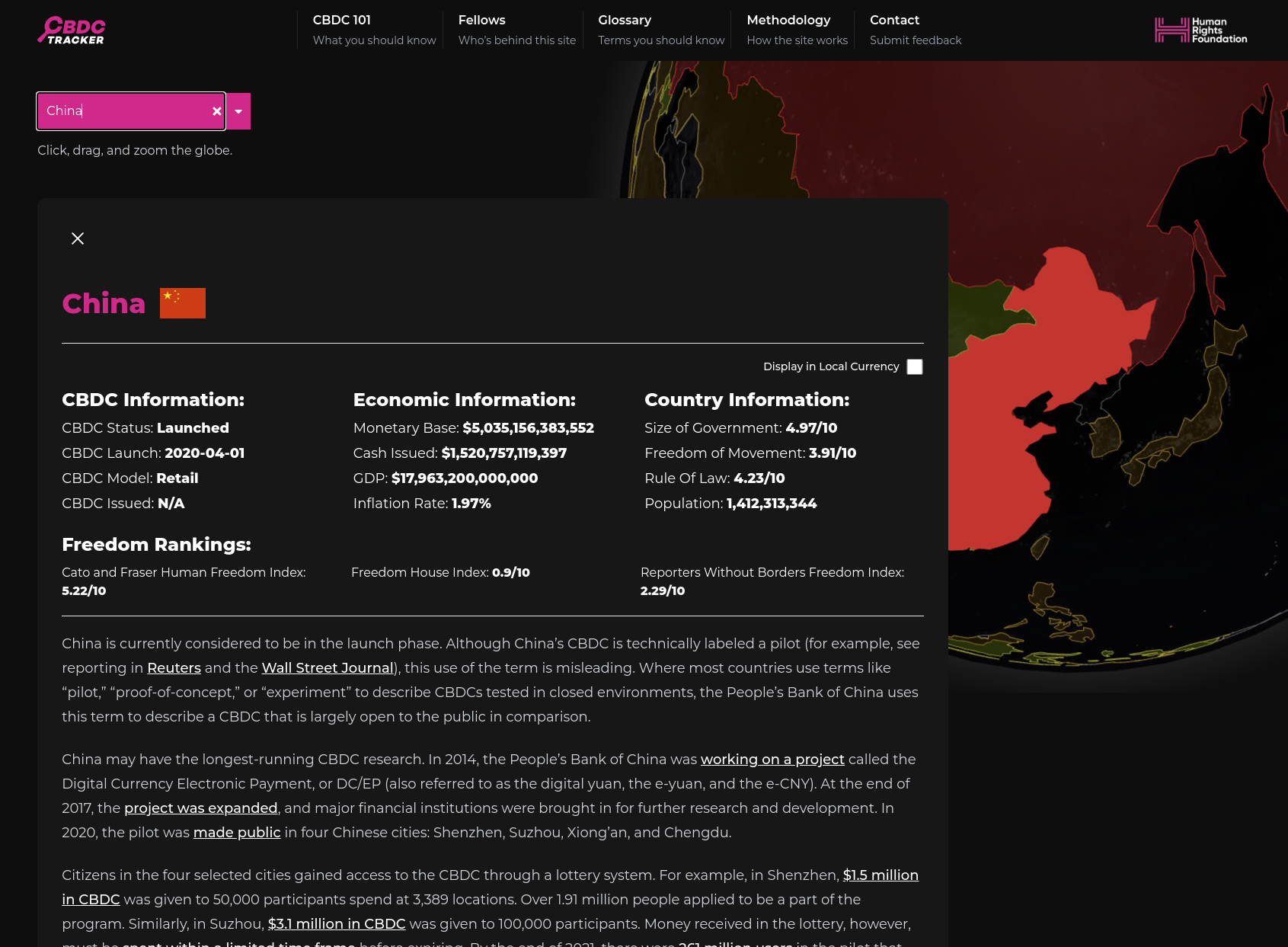

The HRF's new CBDC Tracker allows anyone to quickly check the current status of CBDCs in their country (or any country worldwide) in just a few clicks, get information on the human rights impacts of CBDCs, and quickly read more details on each countries CBDC program. This makes it trivial for even the most non-technical users to keep up to date with vital information surrounding the rapid advance of CBDCs and how it will impact their financial freedoms moving forward.

One of the most powerful aspects of the announcement made by the HRF was a summary of their findings so far while building the CBDC Tracker, showing that CBDCs are far from a niche human rights issue:

– A global trend: The majority of the world’s governments (62%) are actively researching, building, or deploying CBDCs, despite very little public awareness on the topic.

– Authoritarians lead the way: Dictatorships are leading the charge in CBDC deployment. HRF estimates that 3.7 billion people (46% of the world population) are living under autocracies currently experimenting with CBDCs.

– Vanishing privacy: CBDCs may upend traditional privacy norms as they replace paper cash, serving as tools of surveillance and control, especially in dictatorships

– Peer pressure: CBDC adoption is accelerating globally, with few major governments abstaining from the process.

– Adoption challenges: Retail adoption of CBDCs in places like China and Nigeria faces major hurdles. Citizens are skeptical. Governments should be expected to force the issue.

– Government and corporate collaboration: Governments are likely to partner with commercial banks or fintech companies to distribute CBDCs via existing banking or mobile applications.

If you want to learn more about the risks facing us in CBDCs or the background of the CBDC Tracker, we published an article featuring Alex Gladstein, CSO of the HRF last month:

I'd highly recommend you take a few minutes today and explore the CBDC Tracker yourself and consider sharing it with friends and family to help break down the education barrier that governments are relying on to push against financial freedoms with CBDCs:

Join the Conversation

If this post has sparked an idea or motivated you to get involved, there is no better next step then to join the conversation here at freedom.tech! Subscribers can jump straight into the comments below, or you can join our community SimpleX group:

If you have feedback for this post, have something you'd like to write about on freedom.tech, or simply want to get in touch, you can find all of our contact info here: